Foundation & Readiness

Engage core team

Evaluate business structure & potential restructuring

Comprehensive business valuation & transferable assets

Begin estate planning

Align goals — business & personal

Establish clean financials / begin 3 yrs audits or plan for QoE (6–12 mos before)

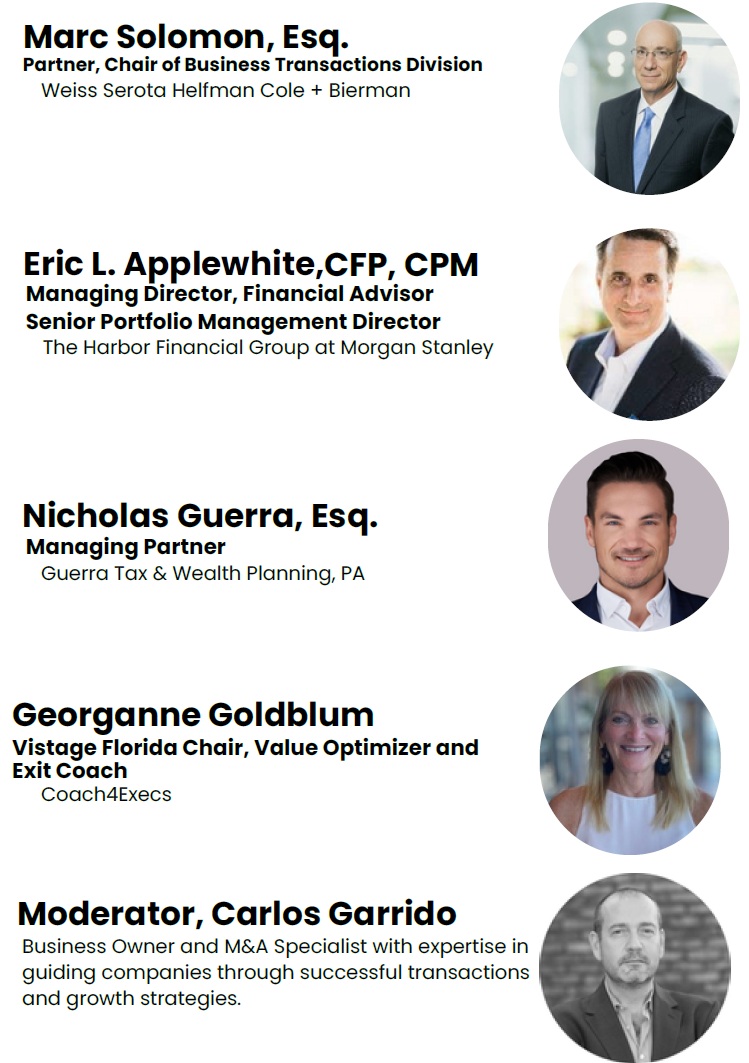

Experts: Value Optimizer (Exit Coach), Tax Attorney, Wealth Manager, Accounting Firm, Valuation Specialist